Crypto Trading Basics

Mastering Crypto Trading Basics: Your Guide to Getting Started

So, you're thinking about getting into crypto trading?

It can seem a bit much at first, right?

All those charts and terms can make your head spin.

But don't worry, it's not as complicated as it looks.

We're going to break down the crypto trading basics for you, step by step, so you can feel more confident about starting.

Think of this as your friendly guide to understanding what crypto trading is all about and how to get your feet wet without getting overwhelmed.

We'll cover the important stuff you need to know to begin your journey.

Key Takeaways

- Understand what crypto trading actually is and the main ideas behind it.

- Learn how to set up your trading space, pick a good exchange, and keep your digital money safe.

- Discover tools that can help make your trading faster and smarter, like bots and browser add-ons.

- Figure out how to make a plan for trading, looking at the market and managing your risks.

- Get the hang of making your first trades and keeping an eye on your investments.

Understanding Cryptocurrency Trading Basics

So, you're looking to get into crypto trading?

It's a bit like learning a new language, but instead of words, you're dealing with digital coins and market movements.

At its core, cryptocurrency trading is about buying and selling digital currencies like Bitcoin or Ethereum, hoping to make a profit from the price changes.

Think of it as a fast-paced market where prices can swing quite a bit, sometimes in just a few hours.

It's not just about buying and holding; trading is more about short-term plays, trying to catch those price ups and downs.

You're basically making bets on whether a coin's value will go up or down.

It's a way to make money with digital assets, and lots of people are getting involved.

You can learn the basics to start your crypto trading journey here.

Setting Up Your Trading Environment

Alright, so you're ready to get your hands dirty with crypto trading.

Before you jump in, you need a solid place to do your trading from.

Think of it like setting up your workshop before you start building something cool.

You wouldn't start building a house without tools and a workbench, right?

Same idea here.

Choosing a Reliable Exchange

First things first, you need to pick an exchange.

This is where you'll actually buy and sell your crypto.

There are tons of them out there, and they all have different features, fees, and security measures.

Some are super popular, others are more niche.

Do your homework here; it's important.

You want an exchange that feels safe and has the coins you're interested in trading.

Look at their track record, how they handle customer support, and what kind of trading pairs they offer.

For beginners, it's often best to start with one of the bigger, more established platforms.

You can always explore others later as you get more comfortable.

Getting started with crypto trading often means picking a platform that fits your needs, and there are resources to help you figure that out to begin trading cryptocurrency.

Securing Your Digital Assets

Now, let's talk about keeping your crypto safe.

This is a big one.

When you buy crypto, it's digital, and like anything digital, it can be a target.

Exchanges have security, but they can also be hacked.

That's why you need to think about how you're storing your coins.

Using strong, unique passwords and enabling two-factor authentication (2FA) on your exchange account is a must.

It's like putting an extra lock on your door. Beyond that, you'll want to look into wallets.

Understanding Wallets and Keys

Wallets are where your crypto actually lives.

There are different types: hot wallets (connected to the internet, like on an exchange) and cold wallets (offline, like a hardware device).

For active trading, you might keep some funds on an exchange, but for long-term holding, a cold wallet is generally considered safer.

You'll also hear about private keys and public keys.

Your public key is like your bank account number – you can share it to receive funds.

Your private key is like your PIN or password; never share your private key with anyone.

If you lose your private key, you lose access to your crypto.

It sounds complicated, but it's really about understanding that you're in charge of your own security.

If you're trading on Solana, you might find tools like NovaClick helpful for managing fees, which can be a good way to optimize your trading costs tips for beginners trading Solana.

Essential Tools for Crypto Traders

So, you're ready to get serious about trading crypto.

That's great!

But just knowing the basics isn't enough.

You need the right gear to actually make moves in the market.

Think of it like this: you wouldn't try to build a house with just a hammer, right?

Crypto trading is similar.

You need tools that help you work faster, smarter, and with more information.

Having the right tools can really make a difference in your trading results.

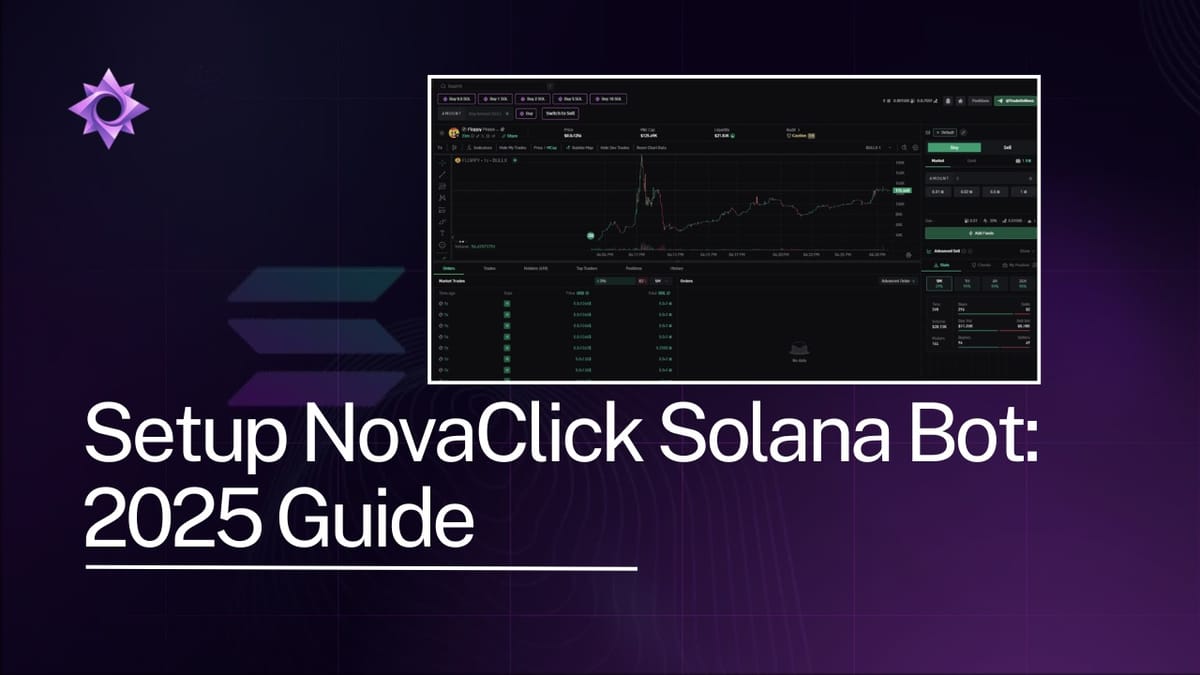

Leveraging Trading Bots for Efficiency

Trading bots can be a real game-changer, especially if you don't have all day to stare at charts.

These automated programs can execute trades based on rules you set.

This means you can potentially catch opportunities even when you're not actively watching the market.

Some bots are designed for specific tasks, like automatically buying or selling when certain price points are hit.

Others can help you manage your portfolio automatically.

It's about making your trading more efficient, so you're not missing out on potential gains because you were busy with something else.

You can find out more about how these bots work and get started with them here.

Utilizing Browser Extensions for Speed

Browser extensions are like little helpers that live right in your web browser.

For crypto traders, they can offer quick access to information or perform actions without needing to open a separate app.

Imagine getting real-time price alerts directly on your screen, or being able to quickly check the details of a token you're interested in.

Some extensions can even help you interact with decentralized applications (dApps) more easily.

They're designed to speed up your workflow and keep you informed.

NovaClick, for instance, offers early access to a toolkit that can give you an edge in tracking markets and identifying opportunities, letting you master these tools before others do.

Real-Time Data and Analytics

This is where you get the actual numbers and insights to make informed decisions.

You need access to up-to-date price charts, trading volumes, and market sentiment.

Tools that provide this kind of data help you understand what's happening right now and what might happen next.

Think about charts that show you price movements over different timeframes, or analytics that tell you how much of a coin is being traded.

This information is what you'll use to figure out if it's a good time to buy or sell.

Using analytics can help you make smarter decisions in the crypto market, and you can explore how to use them to your advantage.

There are many different types of tools available, from charting platforms to on-chain analytics, each offering distinct features to help you make better choices in the market.

Having access to reliable, real-time data is non-negotiable. Without it, you're essentially trading blind. You need to know the current prices, trading volumes, and market trends to make any kind of educated guess about where things are headed. This data helps you spot patterns and make more calculated decisions, rather than just guessing.

Getting access to a wide selection of cryptocurrencies with good liquidity is also important, as it allows you to buy and sell assets with more confidence.

You can find resources that highlight these tools for trading.

Early access to platforms like NovaClick can also provide you with exclusive features and advanced trading tools, helping you optimize your strategies before the public launch and gain a competitive edge.

You can quickly access these benefits by following the steps provided.

Developing a Trading Strategy

So, you've got your setup ready, and you're thinking about actually making some trades.

That's great!

But just jumping in without a plan is like trying to drive somewhere new without a map.

You'll probably get lost, and that's not good for your crypto.

You need a strategy.

This isn't about predicting the future perfectly, but more about having a set of rules for yourself.

Fundamental Analysis in Crypto

This is about looking at the bigger picture of a cryptocurrency.

- What problem does it solve?

- Who is building it?

- Is the project actually being used?

You're trying to figure out if the coin has long-term value.

It's like checking out a company's financial reports before you buy its stock.

For example, you might look at the number of active developers or how many people are using the network.

It's a way to get a feel for the project beyond just the price chart. You can find out more about making your first trade.

Technical Analysis for Market Trends

Technical analysis is all about the charts.

You're looking at past price movements and trading volumes to guess where the price might go next.

Things like support and resistance levels, moving averages, and chart patterns are part of this.

It's a way to spot potential entry and exit points.

For instance, if a price keeps bouncing off a certain level, that might be a support level. Many traders use this to time their trades. You can explore different trading approaches here.

Risk Management Techniques

This is super important.

You don't want to lose all your money on one bad trade.

Risk management is about protecting your capital.

This means deciding how much you're willing to lose on any single trade, maybe 1-2% of your total trading funds.

It also involves using stop-loss orders to automatically sell if the price drops to a certain point.

Another aspect is diversification – not putting all your eggs in one basket.

When you're starting out, using tools like the Nova Sniper Bot can help manage risk by automating trades based on your set parameters, especially in fast-moving markets.

Having a clear strategy, combining both fundamental and technical analysis with solid risk management, is key to staying in the game.

Think about using automated tools.

Platforms like NovaClick, integrated with BullX, let you set up trades automatically.

You can pick your crypto, decide on entry and exit points, and let the system handle it.

This can be really helpful, especially if you're new or don't have time to watch charts all day.

It's a way to execute your strategy consistently. You can learn more about automated trading and how it works.

Executing Your First Trades

Alright, you've got your setup sorted and your strategy in mind.

Now it's time to actually make some trades.

It might seem a bit daunting at first, but it's pretty straightforward once you get the hang of it.

Placing Buy and Sell Orders

When you're ready to enter or exit a position, you'll be placing orders.

The most common types are market orders and limit orders.

A market order is simple: you tell the exchange to buy or sell immediately at the best available price.

This means your trade will go through fast, but you might not get the exact price you were hoping for.

On the other hand, a limit order lets you set a specific price at which you want to buy or sell.

Your order will only execute if the market reaches that price.

This gives you more control over your entry and exit points, which is great for sticking to your strategy.

For example, you might want to buy Bitcoin when it hits $30,000, so you'd place a limit buy order at that price.

It's all about choosing the order type that best fits your immediate needs and trading plan.

Understanding Transaction Fees

Every trade you make will likely come with a small fee.

Exchanges charge these fees for providing their service, and they can add up, especially if you're trading frequently.

These fees are usually a small percentage of the trade value.

Some exchanges might offer lower fees if you hold their native token or if you trade a high volume.

It's a good idea to check the fee structure of your chosen exchange before you start trading.

Keep these costs in mind when calculating your potential profits.

You can often find a table detailing these fees on the exchange's website.

Monitoring Your Portfolio

Once you've made your first trades, you'll want to keep an eye on how your investments are doing.

This is where portfolio monitoring comes in.

You can usually see your holdings directly on the exchange where you traded.

Many traders also use third-party portfolio trackers or even specialized bots like Nova Click to get a consolidated view of their assets across different exchanges and wallets.

Getting an early access code for tools like Nova Click can really streamline this process.

You'll want to track your overall profit and loss, see which assets are performing well, and identify any that might need attention.

It's not just about watching the numbers, though; it's about understanding why they're moving.

Keeping a trading journal can be super helpful here. Jotting down why you entered a trade, what your target was, and how it turned out can teach you a lot about your own trading habits and help you refine your approach over time. It’s like having a personal coach for your crypto journey.

If you're looking to automate some of these processes, tools like the Nova Trading Bot can help execute trades based on your strategies.

You can find more information on how to get started with these kinds of tools to improve your trading efficiency.

Remember, consistent monitoring and analysis are key to adapting your strategy and improving your results in the crypto market.

You can also look into resources that explain patterns like a double bottom in crypto trading to better understand market movements.

Navigating Market Volatility

The crypto market can swing wildly, and that's just part of the game.

You've probably seen prices jump or drop without much warning.

It’s a lot like riding a roller coaster sometimes.

Strategies for High-Volatility Markets

When things get choppy, you need a plan.

One good idea is to dial back or skip using leverage altogether.

Leverage magnifies both gains and losses, so in a volatile market, it can get risky fast.

Also, make sure you're using stop-loss and take-profit orders.

These are like safety nets that can automatically sell your crypto if it drops to a certain price or sell it if it hits your target profit.

It’s smart to wait for better conditions before you jump into a trade, too.

Don't feel pressured to trade just because the market is moving. You can find more on managing risk in these situations on pages like Pocket Option.

Staying Informed About Market News

Keeping up with what's happening is pretty important.

Big news can move prices quickly.

Sometimes, you'll see institutions using low-latency analytics and real-time data to get ahead.

This helps them deal with fluctuating conditions better.

You can also use tools like Nova Click.

It's a Telegram bot and extension that helps you track what big wallets are doing.

By watching influential traders, you can get a sense of where the market might be heading.

It's not about copying them blindly, though.

You still need to think for yourself and do your own research.

This kind of insight can give you an edge, but remember to combine it with your own market analysis.

Adapting to Changing Conditions

Markets change, and you need to change with them.

What worked yesterday might not work today.

Think about how market makers operate; they adjust their strategies all the time.

They might change their bid-ask spread or look for arbitrage opportunities.

You can do the same.

If your current strategy isn't working, don't be afraid to tweak it or try something new.

Being flexible is key to surviving and thriving in crypto.

It’s about learning from each trade and adjusting your approach.

You might even find that using tools like novaclick helps you spot new trends faster, allowing you to adapt more quickly.

Markets can be a bit wild sometimes, making it tricky to know what to do.

Don't let confusing ups and downs stop you from reaching your money goals.

We've got simple tips to help you understand these market swings. Want to learn how to trade smarter, even when things get bumpy? Visit our website today to get started!

Conclusion

So, you've learned the basics of crypto trading.

It's a lot to take in, right?

Remember, starting out means taking it slow.

Don't rush into anything big.

Keep learning, keep practicing, and don't be afraid to make small mistakes along the way – that's how you get better.

There are tools out there, like Nova Click, that can help speed things up and make trading easier, especially if you're on Solana.

But no matter what tools you use, the most important thing is to stay informed and trade smart. Good luck out there!

Frequently Asked Questions

What exactly is crypto trading?

Think of cryptocurrency trading like swapping one type of digital money for another, like Bitcoin or Ethereum, hoping to make a profit. You buy when you think the price will go up and sell when you think it will go down. It's all about buying low and selling high!

What do I need to start trading crypto?

You'll need a place to buy and sell crypto, like an online shop called an exchange. You also need a digital wallet to keep your crypto safe, kind of like a digital bank account. Keeping your account secure with a strong password and maybe two-step verification is super important!

What's the deal with decentralized exchanges?

Decentralized exchanges, or DEXs, are cool because they let you trade directly with other people without a middleman. This means you have more control. Some tools, like browser extensions, can even help you trade faster on these DEXs.

How do I make a trading plan?

You've gotta have a plan! Look at how prices have moved in the past (technical analysis) and learn about what's happening with the crypto itself (fundamental analysis). Also, never risk more money than you can afford to lose. That's called risk management, and it's a lifesaver!

How do I actually buy or sell crypto?

When you decide to buy or sell, you'll place an order. There are different types, like market orders (buy/sell right away at the current price) and limit orders (buy/sell only at a specific price you choose). Just be aware there might be small fees for each trade.

What if the crypto market gets wild?

Crypto prices can jump up and down like a rollercoaster! To handle this, stick to your trading plan, don't panic sell if prices dip, and always keep up with the latest news that might affect prices. Being flexible and informed is key.

More Nova Click Guides: