Is Rug Pulling Legal?

Understanding the Legal Ramifications of Crypto Scams

So, you've heard about those crypto scams, the ones where people put their money into a new coin, only for the creators to suddenly disappear with all the funds.

It sounds pretty wild, right?

You might be wondering, is rug pulling legal?

It's a question many people have when they see these projects pop up and then vanish.

Let's break down what these scams are and what the law says about them.

Key Takeaways

- Rug pulls are a type of crypto scam where developers abandon a project and run off with investor funds.

- These actions are generally illegal, falling under existing fraud and theft laws.

- Authorities are increasingly focusing on crypto scams, leading to enforcement actions.

- Investors can take steps to protect themselves by researching projects and looking for warning signs.

- International cooperation is developing to tackle these cross-border digital asset crimes.

Understanding the Nature of Rug Pulls

Defining Crypto Rug Pulls

So, what exactly is a crypto rug pull?

Think of it like this: you invest in a new digital currency project, maybe because it's got a lot of buzz or promises big returns.

You buy in, feeling pretty good about it.

Then, suddenly, the people behind the project disappear.

They take all the money that people invested, and the tokens you hold become worthless.

It's a scam where the project creators vanish with investor funds, leaving you with digital assets that are no longer worth anything.

This deceptive practice is a serious issue in the crypto space.

Common Tactics Employed in Rug Pulls

Rug pulls aren't all the same; scammers use different tricks.

One common method is to create a lot of hype around a new token.

They might use social media influencers or create a sense of urgency, making you feel like you need to buy in now.

Once enough people have invested, the founders might suddenly remove all the liquidity from the trading pool.

This means you can't sell your tokens anymore.

Another tactic involves creating a 'honeypot,' where you can buy the token but can't sell it.

Sometimes, they just dump all the tokens they hold onto the market after hyping it up, crashing the price and making their own tokens worthless.

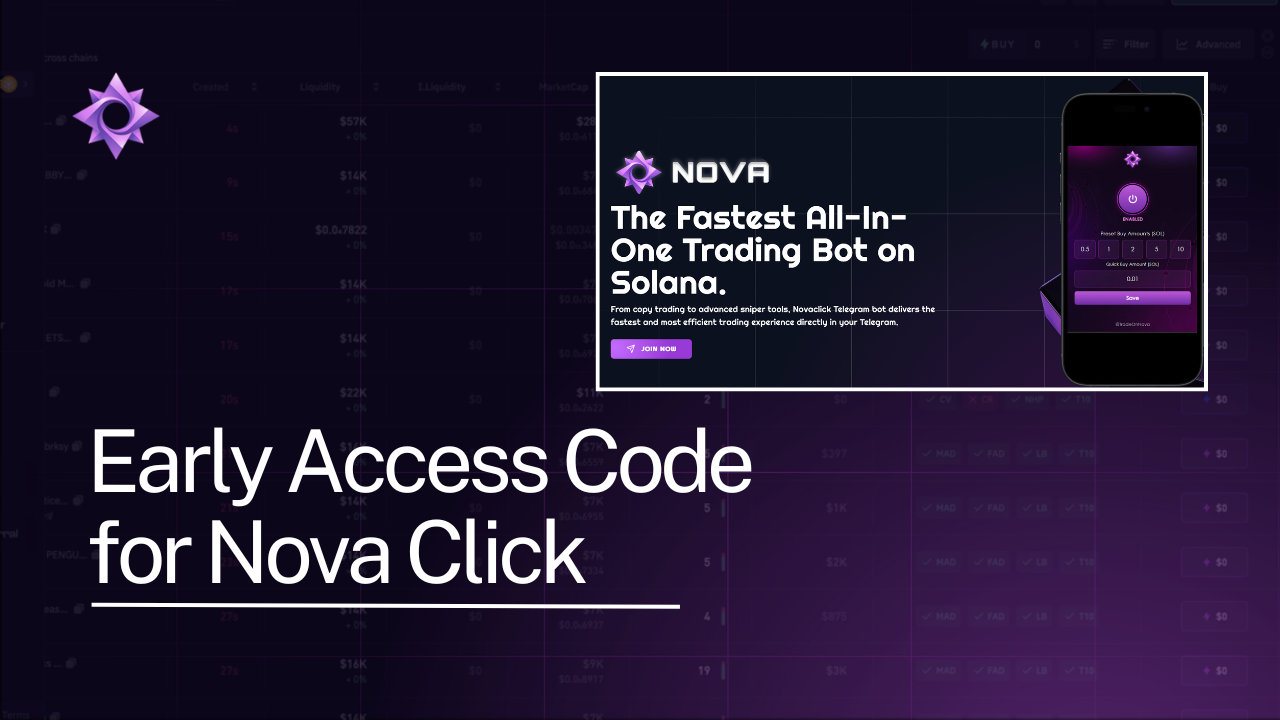

Tools like the Nova Click trading extension can help you get into new tokens quickly, but you still need to be aware of these scam tactics. It’s important to know how to spot these red flags before you invest your money.

It’s easy to get caught up in the excitement of new crypto projects, especially when you see others making quick profits. However, the decentralized nature of many crypto markets means that oversight can be limited, making it easier for bad actors to operate.

Here are some common ways rug pulls happen:

- Liquidity Removal: Developers pull the pooled funds from decentralized exchanges, making the token un-tradable.

- Token Dumping: Founders sell off large amounts of their own tokens, crashing the price.

- Honeypots: Creating tokens that can be bought but not sold.

- Project Abandonment: Simply disappearing after raising funds, leaving the project unfinished.

When you're looking at new tokens, especially on platforms like Solana, using tools that offer features like Bubble Maps can help you see who is holding the tokens and how liquidity is structured.

This kind of analysis can sometimes reveal suspicious patterns before you commit your funds.

The Legal Landscape of Crypto Scams

When you're looking at the world of crypto, it's not exactly a free-for-all, legally speaking.

There are rules, and they're still being figured out, but that doesn't mean you can just do whatever you want.

Think of it like this: the government and financial watchdogs are still building the road, but they've put up plenty of 'no trespassing' signs.

Regulatory Frameworks for Digital Assets

Different countries are tackling crypto regulation in their own ways.

Some are embracing it, trying to create clear rules, while others are more cautious.

In the U.S., agencies like the SEC and CFTC are involved, looking at how crypto fits into existing financial laws.

It’s a bit of a patchwork, and what’s allowed in one place might be frowned upon elsewhere.

For instance, in Canada, crypto is treated more like a commodity by the CRA, which affects how you handle taxes on your gains.

The goal is generally to protect investors and keep the financial system stable, but the specifics are always changing.

Enforcement Actions Against Fraudulent Schemes

Even with the evolving rules, authorities are actively going after scams.

If a project looks too good to be true, it probably is.

When projects pull the rug, they're often breaking laws related to fraud, theft, and securities violations.

Regulators are getting better at spotting these schemes and taking action.

This can involve shutting down fraudulent operations, freezing assets, and prosecuting the people behind them.

Tools like the Nova Sniper Bot, while designed for legitimate trading on the fast Solana blockchain, can also be misused if not operated responsibly, highlighting the need for clear guidelines and enforcement.

It's important to remember that the lack of perfectly defined laws doesn't create a legal loophole for bad actors. Existing laws against fraud and theft still apply, and authorities are adapting them to the digital asset space.

Is Rug Pulling Legal: Examining the Illegality

So, is pulling the rug on crypto investors actually legal?

The short answer is a resounding no.

While the decentralized nature of crypto can sometimes feel like the Wild West, the actions involved in a rug pull are far from legal.

Think about it: you're promised something valuable, an investment opportunity that's supposed to grow, but instead, the people behind it vanish with your money.

That sounds a lot like fraud, doesn't it?

Fraudulent Misrepresentation in Crypto

When someone creates a new cryptocurrency or token, they often make claims about its future, its technology, or its team.

If these claims are false, and the creators know they're false when they make them, that's fraudulent misrepresentation.

It’s like selling a car with a faulty engine but telling the buyer it’s in perfect condition.

In the crypto world, this often involves hyping up a project with fake roadmaps, exaggerated partnerships, or even stolen code, all designed to get you to invest. The goal is to make you believe in a project that has no real substance, which is a key element in many crypto scams.

Theft and Embezzlement in Digital Asset Schemes

Beyond just lying, rug pulls often involve outright theft.

When the creators of a project drain the liquidity pool, essentially removing all the value from the token, they are taking something that doesn't rightfully belong to them.

This is akin to embezzlement, where someone entrusted with funds or assets uses them for their own illicit purposes.

Imagine a company's CEO taking all the company's cash and disappearing; it's that kind of betrayal of trust, but in the digital asset space.

The team at Nova Click, for instance, has seen how these schemes operate, often leaving investors with worthless digital tokens.

These actions are not just unethical; they are criminal offenses.

When you invest in a crypto project, you're trusting that the creators will act in good faith.

A rug pull violates that trust in a big way.

It's not just about losing money; it's about being deliberately deceived and defrauded.

The legal systems in place are designed to punish such behavior, recognizing it as a serious crime.

You can find more information on how to identify and prevent these fraudulent acts in the Web3 space.

Consequences for Perpetrators of Rug Pulls

So, you've been thinking about what happens to the folks who pull off these rug pulls?

It's not exactly a walk in the park for them, legally speaking.

Authorities are getting smarter about tracking down these crypto scams.

Criminal Penalties and Fines

When someone is caught orchestrating a rug pull, they can face some pretty serious criminal charges.

We're talking about things like wire fraud, mail fraud, and conspiracy, depending on how the scam was carried out.

If convicted, the penalties can include hefty fines and significant prison time.

For instance, a conviction for wire fraud alone can land you in jail for up to 20 years and come with fines of up to $250,000, or even double that if the fraud impacts a financial institution.

It's a stark reminder that these aren't just victimless digital pranks; they are serious financial crimes.

You might even see charges related to money laundering if they try to hide the illicit gains, which is something regulators are watching closely, as highlighted in discussions about Anti-Money Laundering for cryptocurrency.

Civil Litigation and Asset Recovery

Beyond criminal charges, victims of rug pulls can also pursue civil action.

This means you could sue the perpetrators to try and get your money back.

It's a bit like trying to recover stolen property, but in the digital asset world.

Courts can order the return of stolen funds or assets, and sometimes even award damages to compensate for losses.

This is where services that help track illicit crypto transactions can be useful for investigators and victims alike.

The goal is to make it as difficult as possible for scammers to keep what they've stolen.

It's a tough road, but there are avenues to explore if you've been targeted.

Remember, understanding the nature of these scams, like the common tactics employed in rug pulls, is your first line of defense.

It's important to remember that while the technology is new, the underlying principles of fraud and theft still apply. Law enforcement agencies and regulatory bodies are increasingly equipped to investigate and prosecute these types of schemes, even when they involve digital assets.

The idea of a rug pull, where liquidity is suddenly withdrawn, leaving investors with worthless tokens, is a tactic that has parallels in traditional markets but is amplified in the fast-paced crypto space.

This is why being informed about potential scams, such as the "pig butchering" scheme that targets Americans, is so important for your financial safety.

Investor Protection and Due Diligence

When you're getting into crypto, it's easy to get excited about the potential gains.

But before you jump in, you really need to do your homework.

Protecting your investment means being smart about where you put your money.

Think about it: anyone can create a token and promise the moon.

That's where due diligence comes in.

You need to look past the hype and see what's really going on under the hood.

Are the developers transparent?

Do they have a solid plan, or is it just vague promises?

Checking out the project's whitepaper, team members, and community engagement can tell you a lot.

Tools can help with this.

For instance, using something like Nova Click can give you an edge. It helps you track wallets of influential people or early investors in the memecoin space.

By seeing where smart money is going, you might get a better idea of which projects have real traction.

It’s not about blindly following, but about gathering more information to make a better decision.

You can even get a novaclick early access code to try out some of its features.

Here are some things to watch out for:

- Liquidity: Is there enough locked liquidity to support trading? If not, it's a huge red flag.

- Tokenomics: How is the token distributed? Are a few wallets holding way too much?

- Team: Are the developers doxxed (publicly identified)? Do they have a track record?

- Community: Is there a real, engaged community, or just bots pumping the price?

It's also wise to understand the risks associated with the platforms and services you use. Even with the best intentions, third-party involvement can introduce vulnerabilities. Always verify contract addresses and understand transaction details before confirming anything.

When you're looking at new tokens, especially on platforms like Twitter, you might see contract drops.

Using a browser extension like Nova Click can help you catch these quickly.

It can even help you verify contract details using tools like Solscan, which is pretty handy for avoiding scams.

Remember to check the liquidity and holder distribution.

Don't just buy because someone famous tweeted about it.

You might want to look into how to snipe new tokens on Twitter using the Nova Click extension to get a feel for how these tools work.

Ultimately, staying safe in crypto is about being informed and cautious.

Don't invest more than you can afford to lose, and always do your own research.

The crypto world is always changing, and staying updated on evolving threats is important, so keeping an eye on things like blockchain analytics can be helpful.

International Cooperation in Combating Crypto Fraud

When you're dealing with crypto scams, especially those that cross borders, you quickly realize that no single country can tackle this alone.

It’s a global problem, and that means we need global solutions.

Think about it: a scammer could be in one country, their victims spread across many, and the stolen funds routed through servers in yet another.

This is where international cooperation comes into play.

Cross-Border Enforcement Challenges

One of the biggest headaches is figuring out which laws apply and how to enforce them when different jurisdictions are involved.

Each country has its own rules about digital assets and fraud.

When a scam like a rug pull happens, investigators might struggle to get information or freeze assets if they're held in a country with different legal processes.

It’s like trying to play a game where everyone has a different rulebook.

For instance, a criminal network in Spain was recently broken up for running a crypto investment fraud that hit over 5,000 victims worldwide, laundering a massive amount of money.

This case really shows how complex it gets when you have to coordinate across different legal systems to track down illicit profits.

Collaborative Efforts to Disrupt Illicit Activities

To get around these challenges, countries are working together more.

They share information, coordinate investigations, and try to harmonize their laws.

This collaboration is key to actually catching these fraudsters and getting victims their money back.

Agencies are using blockchain intelligence to trace where the stolen funds go, which helps in building cases.

The U.S., for example, has taken action to seize millions in crypto linked to fraudulent schemes, showing how enforcement can work when different bodies cooperate.

Tools and platforms are also emerging to help traders stay ahead.

For instance, using a tool like the nova trading bot can give you an edge by providing real-time market insights, which is helpful when you're trying to spot legitimate projects versus scams.

It’s about having the right information to make smarter decisions, especially in the fast-paced world of crypto.

Effective international cooperation is vital for dismantling these global fraud networks.

Working together across borders is key to stopping crypto scams.

When countries team up, they can share information and catch bad guys who try to trick people with digital money.

This teamwork helps make the online world safer for everyone.

Want to learn more about how we can fight these scams together? Visit our website to see how you can help.

So, What's the Takeaway?

Look, when it comes to crypto scams like rug pulls, the law is pretty clear: they're illegal.

You've seen how these schemes work and the trouble they can cause.

If you've been targeted, know that there are steps you can take.

Reporting these incidents is important, not just for you, but to help protect others too.

Staying informed and being careful with your investments is your best defense.

It's a wild space out there, so always do your homework before putting your money into anything.

Frequently Asked Questions

What exactly is a crypto rug pull?

Think of a rug pull like this: someone builds a cool-looking crypto project, gets lots of people to put their money in, and then suddenly takes all the money and disappears, leaving everyone else with worthless digital coins. It's a total scam!

Is it against the law to do a rug pull?

It's definitely not legal! Rug pulling is considered fraud, plain and simple. Depending on where you are and how big the scam was, you could face serious jail time and have to pay huge fines.

Can you get your money back if you're a victim of a rug pull?

You bet! If you've been tricked by a rug pull, you might be able to get your money back through the courts. This usually involves suing the scammers, but it can be tricky because they often try to hide.

How do scammers pull off these rug pulls?

Scammers are sneaky. They might promise huge profits, create fake websites, or pretend to be famous people. They often make it look like a real, legit project, but it's all a lie to steal your cash.

How can you avoid falling for a rug pull?

You've got to be smart and do your homework! Look out for projects that promise crazy high returns super fast, have anonymous teams, or lack clear information about how the project works. Always be suspicious if something seems too good to be true.

Are authorities trying to stop these crypto scams?

Governments and law enforcement agencies around the world are working together to catch these scammers. They share information and try to track down criminals no matter where they are hiding, making it harder for them to get away with it.

More Nova Click Guides: