SOL Price Analysis: Technical Indicators for Traders

So, you're looking to get a better handle on the sol price analysis game?

It can feel like a lot when you're starting out, with all the different tools and strategies out there.

But don't worry, we're going to break down how you can use some pretty neat features to make smarter moves.

Think of this as your guide to understanding what's happening with Solana prices and how to act on that information.

Key Takeaways

- You can copy trades from other Solana wallets to get insights into their strategies.

- Limit orders let you set automatic buy and sell points based on market cap or price.

- Nova Click helps you process transactions super fast on decentralized exchanges.

- The sniper module is there to help you catch opportunities with migrating tokens and new liquidity pools.

- You can manage your trading positions by setting take profit and stop loss levels to control your earnings and risks.

Understanding SOL Price Analysis Tools

When you're trading Solana tokens, having the right tools makes a big difference.

It's not just about guessing; it's about using information to make smarter moves.

We've put together some features to help you get a handle on the market.

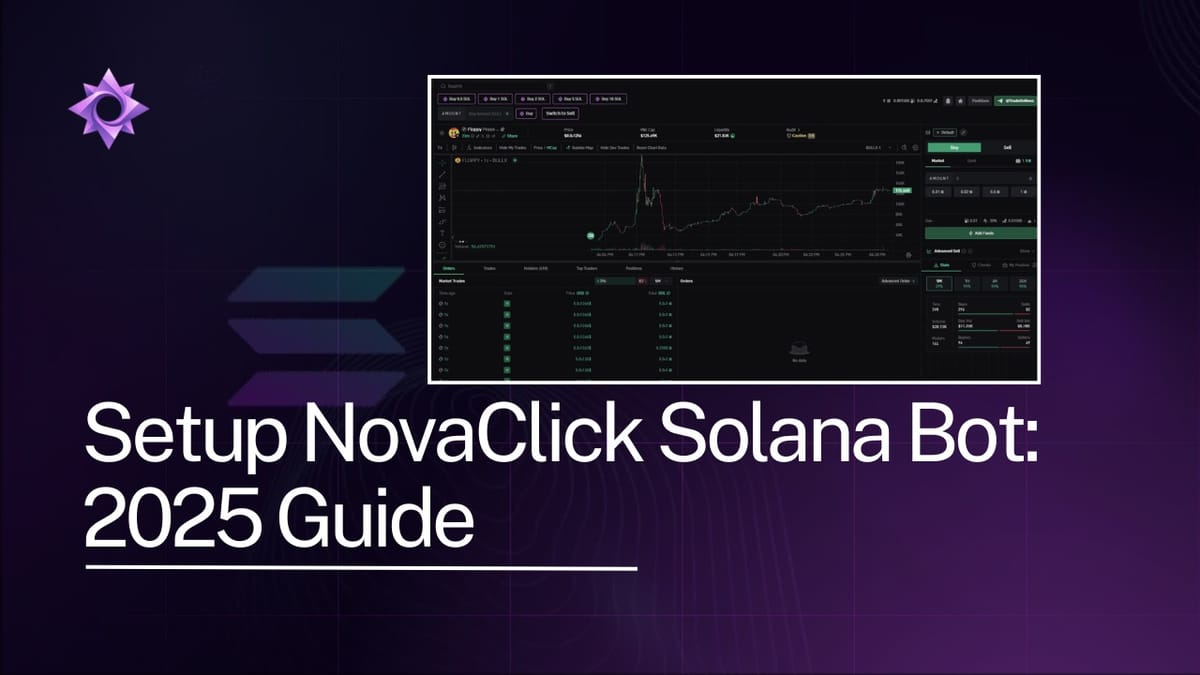

Nova Bot Overview for Solana Trading

Think of Nova Bot as your assistant for navigating the Solana ecosystem.

It's designed to help you keep track of things and make trades more efficiently.

You can use it to monitor token performance and execute trades without constantly watching charts.

It's a way to automate some of the more tedious parts of trading, letting you focus on strategy.

Key Features for SOL Price Analysis

Nova Bot comes with several features that can help you analyze SOL prices and make trading decisions.

You can set up alerts for specific price movements or market cap changes.

There are also tools for tracking token liquidity and volume, which are important indicators of a token's health.

The goal is to give you the data you need, when you need it.

Here's a quick look at some of the analysis tools:

- Market Cap Tracking: Monitor the total value of a token.

- Liquidity Monitoring: See how easily a token can be bought or sold.

- Volume Analysis: Understand the trading activity for a token.

- Price Alerts: Get notified when prices hit your target levels.

User Agreement and Financial Risk Disclaimer

Before you start using Nova Bot, it's important to understand a few things.

We want to be clear that Nova Bot is a tool to help with your trading, but it doesn't offer financial advice.

Trading on the Solana network, like any crypto trading, comes with risks.

You could lose money, and that's something you need to be prepared for.

You are responsible for all your trading decisions.

We also want to mention that network fees and transaction speeds can vary, and while we aim for efficiency, we can't control every aspect of the blockchain.

It's always a good idea to understand the fees and costs involved in any transaction.

Remember, using the bot means you agree to these terms and understand the potential risks involved in trading digital assets.

Leveraging Copy Trading for SOL Insights

Copy trading lets you mirror the actions of other traders on the Solana network.

It's a way to learn from experienced users or automate your trading based on proven strategies.

You can select any wallet address on Solana and have your bot follow its trades.

This can be a good way to get started, especially if you're not sure about making your own trading decisions yet.

To get started with copy trading, you'll need to set up a new task.

This involves picking the wallet you want to copy.

After that, you can decide how you want to copy its trades.

Do you want to copy the exact amount they buy, or a percentage of it?

Maybe you prefer to set a fixed amount for your own buys, regardless of what the copied wallet does.

You can also set a maximum amount of SOL you're willing to use for these trades.

There are also some filters you can use to refine your copy trading.

You can set a minimum or maximum market cap for tokens.

This means your bot will only copy trades for tokens within that specific market cap range.

You can also set buy triggers, which are minimum or maximum amounts the copied wallet must buy into a token before your bot follows.

Copy trading can be a powerful tool, but it's important to remember that past performance doesn't guarantee future results.

Always do your own research and understand the risks involved.

You can manage your copy trade settings, including take profit and stop loss levels, to help manage your risk.

Here’s a quick look at the buy amount settings:

| Setting | Description |

|---|---|

| Exact | Copies the exact buy amount from the wallet being copied. |

| Percentage | Copies a set percentage of the buy amount used by the copied wallet. |

| Fixed | Lets you set your own fixed amount to buy on each token. |

| Maximum Buy Amount | Sets the maximum amount of SOL you wish to purchase the tokens with. |

Remember, you can use tools like Nova Click to help process these transactions quickly once you've set up your copy trading strategy.

It helps make sure your trades happen fast, especially with volatile tokens.

Advanced Trading with Limit Orders

When you're ready to move beyond simple buys and sells, limit orders offer a way to automate your trading based on specific conditions.

Think of them as pre-set instructions for the bot.

You can tell it exactly when to buy or sell a token based on its market cap or a specific price point.

This means you don't have to constantly watch the charts yourself.

Setting Market Cap and Price Triggers

With limit orders, you can set triggers for both market capitalization and price.

For instance, you might want to buy a token only when its market cap reaches $5 million, or perhaps when its price hits a certain SOL value.

You can input these values directly into the bot. If you decide you don't want a trigger active anymore, just set it to zero.

This gives you a lot of control over your entry and exit points, helping you get in at a better price or sell before a potential drop.

You can also set a trigger for when the developer of a token sells, which can be a useful signal.

Automating Buy and Sell Transactions

Once your triggers are set, the bot handles the rest.

It will automatically execute a buy or sell transaction when your specified conditions are met.

This is where tools like Nova Click really shine. Nova Click allows you to process these transactions almost instantly.

After setting up your limit order, you can use Nova Click's presets or enter a custom amount to execute the buy or sell.

You'll get a confirmation on Telegram, and your position will be managed within Nova.

It's about making sure your trades happen exactly when you want them to, without you needing to be glued to your screen.

This is a big step up from manual trading, especially in fast-moving markets.

Customizing Buy Fees and Slippage

To make sure your automated trades go through smoothly, you'll want to adjust the buy fees and slippage.

The buy fee is an extra amount you pay to validators to prioritize your transaction, which can be important for volatile tokens.

Similarly, slippage is the acceptable price difference between when you place the order and when it actually executes.

Setting these correctly helps prevent your orders from failing or getting filled at a much worse price than expected.

You can fine-tune these settings, much like you can with other trading actions on the platform, to optimize for speed and execution. For more on how fees affect transaction speed, you can check out the details on fee structures.

Optimizing Transactions with Nova Click

When you're trading on Solana, speed really matters.

That's where Nova Click comes in.

Think of it as your personal assistant for making trades happen faster and smoother, especially when you're using platforms like BullX or Photon.

It's designed to cut down on those annoying delays and make sure you don't miss out on opportunities.

Instantaneous Transaction Processing

Nova Click works by connecting directly to your Telegram bot and using Nova's own servers.

This means your buy and sell orders are processed almost instantly, cutting out a lot of the usual waiting time.

You'll see quick buy and sell buttons appear right on the decentralized exchanges you're using.

This is a big deal when prices are moving fast.

It’s all about getting your trades executed before the market shifts.

Utilizing Quick Buy Presets

One of the coolest things about Nova Click is setting up your own quick buy buttons.

You can tell the bot exactly how much SOL you want to spend – maybe 0.5 SOL, 1 SOL, or whatever amount you usually trade.

When you're on a token's page, you'll see these preset buttons.

Just click one, and Nova Click handles the rest, sending the transaction through its servers.

This saves you from typing in amounts every single time, which is a lifesaver during busy trading periods.

You can set these up easily through the bot's settings.

Real-Time Execution on DEXs

Nova Click integrates directly with popular DEX interfaces, meaning you don't have to switch between different apps or windows to make a trade.

The quick buy/sell buttons appear right where you need them.

This makes the whole process feel much more streamlined.

You can even manage your positions and execute sell orders directly from the Telegram bot, giving you control from anywhere.

If you're looking to speed up your interactions with the Solana ecosystem, checking out some of the leading DeFi applications might show you where these tools fit in.

Sniper Module for SOL Token Opportunities

When you're looking to catch those fast-moving SOL tokens right as they launch or migrate, the Sniper module is your go-to tool.

It's designed to help you get in on promising new tokens before the crowd does.

Think of it as your early bird special for the Solana ecosystem.

Sniping Migrating Tokens and Liquidity Pools

This module lets you target tokens that are moving from one platform to another, like migrating from Pump.Fun.

You can also set it up to catch new liquidity pools as soon as they're created on decentralized exchanges.

It's all about being there at the right moment.

You can configure tasks to watch for specific token addresses or even developer wallets, aiming to snag tokens before they become widely known.

This is where tools like Nova Click can really speed things up, letting you set up these sniper tasks quickly.

Understanding Sniper Modes: Ultra V2 and Demon Mode

Nova offers different ways to snipe, each with its own speed and complexity.

You've got the standard modes, which are straightforward, and then there are the advanced ones like Ultra V2 and Demon Mode.

Ultra V2 is built for speed, using newer on-chain tactics.

Demon Mode takes it a step further, aiming for even faster transaction processing, often by using multiple processors and optimizing fees.

Choosing the right mode depends on how quickly you need to act and how much you're willing to fine-tune the settings.

Here's a quick look at the modes:

| Mode | Description |

|---|---|

| Ultra | The original sniping option, simpler with fewer settings. |

| Ultra V2 | Advanced on-chain tactics for faster transaction processing. |

| Demon Mode | Speed-enhanced Ultra V2, using multi-processor submission and lower fees. |

Configuring Sniper Tasks and Parameters

Setting up a sniper task involves a few key details.

You'll need to specify the token address you're interested in, choose which of your wallets will be used for the purchase, and decide on your buy amount.

Slippage is also important – setting it correctly can mean the difference between getting your trade filled or not, especially with volatile tokens.

You can also set up Take Profit and Stop Loss levels right within the sniper module to manage your risk automatically.

This kind of automation is what makes tools like Photon Bot so useful for staying ahead.

Remember to adjust your buy fees and tips. These can influence how quickly your transaction gets processed by the network, which is critical when you're trying to snipe a token that's moving fast. A small tip can sometimes make all the difference in getting your order executed before others.

Getting the parameters right is key to successful sniping.

You can even create presets for your common settings, so you don't have to re-enter everything each time.

This makes it much faster to react when a new opportunity pops up, like those mentioned in discussions about Snorter Token.

Managing SOL Positions and Profitability

Managing your SOL positions effectively is key to locking in profits and minimizing potential losses.

You can automate your selling process using limit orders, which allow you to set specific profit targets or stop-loss levels.

This means you don't have to constantly watch the market; the bot handles it for you.

Here's how you can set up these crucial management tools:

- Automated Selling with Limit Orders: When you're in a position, you can set a limit order to automatically sell a portion or all of your holdings when a certain condition is met. This could be when the token reaches a specific price, a developer sells, or even when a particular market cap is hit. This is a great way to take profits without manual intervention.

- Setting Take Profit and Stop Loss Levels: These are vital for managing risk. A Take Profit (TP) level automatically sells your tokens when they reach a predetermined profit percentage. Conversely, a Stop Loss (SL) level automatically sells your tokens if they drop to a certain loss percentage, helping to protect your capital. You can configure these directly within your trading tasks.

- Managing Multiple Wallet Holdings: If you manage several wallets, Nova makes it easier to keep track of your SOL positions across all of them. When you look at a specific token, you can see which wallets hold it and then choose to sell a percentage from any or all of them. This consolidated view helps in making informed decisions about your overall portfolio.

Using tools like Nova Click can also streamline your transaction management.

Once your positions are set up, you can process buys and sells quickly.

It's all about having a plan and letting the tools work for you, so you can focus on finding the next opportunity.

Remember, understanding these management features is just as important as finding good trades in the first place.

It's about smart trading, not just active trading.

You can find more details on how to manage your trades by looking at how other traders approach their strategies, like those mentioned by top KOLs in Solana trading.

Proper position management is the backbone of consistent profitability in the volatile crypto market. Don't leave your gains to chance; set your parameters and let the automation work.

Fee Structures and Transaction Speed

When you're trading on Solana, understanding the fees and how transaction speed works is pretty important.

It's not just about the price of the token; it's also about how much you pay to get your trades done and how quickly they actually happen.

Solana itself is known for being really fast and cheap.

Most transactions there cost next to nothing, like fractions of a penny.

But when you're using a trading bot or specific tools, there are a few extra layers to consider.

Understanding Buy and Sell Fees

Think of buy and sell fees as a small payment to the network validators.

Paying a bit extra helps make sure your transaction gets picked up and processed faster, especially when things are busy.

You can usually adjust this fee.

For example, a common range might be between 0.001 SOL and 0.01 SOL, depending on how wild the token's price is moving.

The Role of Buy Tips in Transaction Priority

Beyond the basic fee, there's also something called a 'buy tip'.

This is an extra incentive for validators.

The higher the tip, the more likely your transaction is to be prioritized.

It's similar to the fee but specifically for buys.

If you're trying to get into a fast-moving token, a good buy tip can make a big difference.

We're talking amounts like 0.005 SOL to 0.02 SOL, again, depending on how crazy the market is.

Adjusting Fees for Optimal Performance

This is where tools like Nova Click come in handy.

Nova Click lets you process transactions almost instantly.

When you're using it to buy tokens, you can set these fees and tips directly.

For instance, you can configure your buy fee and buy tip amounts right within the settings.

This means you have direct control over how much you're willing to pay for speed.

You can even set up quick buy presets with specific fee and tip amounts, so you don't have to type them in every single time.

It's all about balancing cost with getting your trades executed when you want them to be.

Here's a quick look at typical fee and tip ranges:

| Type | Low | Average | High |

|---|---|---|---|

| Buy Fee | 0.001 SOL | 0.005 SOL | 0.01 SOL |

| Buy Tip | 0.005 SOL | 0.01 SOL | 0.02 SOL |

Remember, paying higher fees and tips doesn't always guarantee your transaction will be first, but it significantly increases the chances, especially during periods of high network congestion. It's a trade-off between cost and speed.

Understanding how much it costs to make a trade and how quickly it happens is super important.

We've made our system easy to figure out, so you know exactly what you're paying and how fast your deals go through.

Want to see how simple and speedy our trading can be?

Check out our website to learn more!

Conclusion

So, you've looked at the charts and figured out how to use some of these tools.

Remember, these indicators are just guides, not crystal balls.

You still need to watch the market and make smart choices.

Tools like Nova Click can speed things up, and features like Copy Trade or Limit Orders can help you automate parts of your strategy.

Don't forget about managing risk with things like Stop Loss and Take Profit settings.

Keep practicing, stay informed, and you'll get a better feel for how to use these tools to your advantage when trading SOL.

Frequently Asked Questions

What exactly does Nova Bot do?

Nova Bot helps you trade tokens on the Solana network. Think of it like a super-smart assistant for buying and selling crypto. It can help you find good deals, trade quickly, and even copy what other successful traders are doing.

How do limit orders work with Nova Bot?

You can use Nova Bot to automatically buy or sell tokens when they reach a certain price or value. It's like setting an alarm for your trades, so you don't have to constantly watch the market yourself.

What is copy trading and how can it help me?

Copy trading lets you follow and copy the trades made by other wallets. If you see someone making good trades, you can set up Nova Bot to automatically copy their moves, which can be a great way to learn and profit.

What is Nova Click?

Nova Click is a tool that makes trading even faster. It works with other bots like BullX and Photon, letting you make trades with just a click, right on the trading platforms. It's designed to speed things up and make trading simpler.

What is the sniper module for?

The sniper module helps you catch new tokens right when they become available, especially those that are moving to a new place or have just added trading money (liquidity). It's built to be super fast so you don't miss out on potential opportunities.

How can I manage my profits and losses automatically?

You can set up rules to automatically sell your tokens if they drop in price to a certain point (stop loss) or sell them if they go up by a certain amount (take profit). This helps you manage your money and avoid big losses or lock in your gains..

More Nova Click Guides: